17+ Einhorn tech bubble letter ideas

Home » tech Info » 17+ Einhorn tech bubble letter ideasYour Einhorn tech bubble letter images are ready in this website. Einhorn tech bubble letter are a topic that is being searched for and liked by netizens today. You can Find and Download the Einhorn tech bubble letter files here. Get all free vectors.

If you’re searching for einhorn tech bubble letter pictures information linked to the einhorn tech bubble letter topic, you have pay a visit to the ideal site. Our website frequently gives you suggestions for refferencing the highest quality video and image content, please kindly search and find more enlightening video content and images that match your interests.

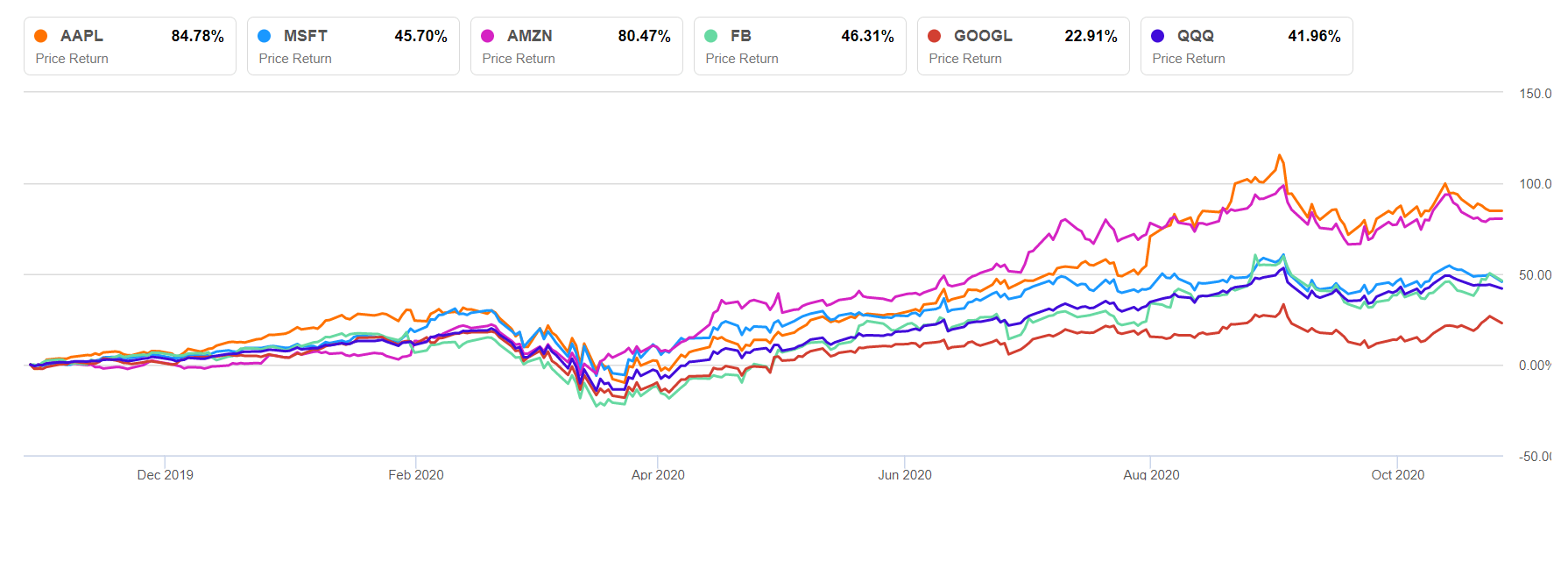

Einhorn Tech Bubble Letter. Bloomberg – Technology stocks are in an enormous bubble Greenlight Capitals David Einhorn said in a letter to investors. Hedge fund manager David Einhorn who famously called out Lehman Brothers before its 2008 collapse wrote in a quarterly letter to clients this week that. Our working hypothesis which might be disproven is that September 2 2020 was the top and the bubble has already popped he wrote in. The fund is down 161 through September and has been trying to recoup losses.

Einhorn At Sohn Investment Conference From businessinsider.com

Hedge fund manager David Einhorn who famously called out Lehman Brothers before its 2008 collapse wrote in a quarterly letter to clients this week that. Einhorn who runs Greenlight Capital wrote in a letter we are in the midst of an enormous tech bubble but noted September 2 2020 was the top and the bubble has already popped. Our working hypothesis which might be disproven is that. Heres an excerpt from the letter. As for the question of sanity we are now in the midst of an enormous tech bubble. Greenlight Capitals David Einhorn warns about a bubble in technology and also the perilous political climate in the US.

Greenlight Capitals David Einhorn warns about a bubble in technology and also the perilous political climate in the US.

In early 2016 he prematurely identified what we thought was a bubble he wrote in the letter. David Einhorns Greenlight Capital was up 59 for the third quarter compared to the SP 500s 89 gain. The fund is down 161 through September and has been trying to recoup losses. Einhorn who runs Greenlight Capital wrote in a letter we are in the midst of an enormous tech bubble but noted September 2 2020 was the top and the bubble has already popped. Greenlights October return pared this years losses to 96 according to an investor update viewed by Bloomberg. Greenlight Capitals David Einhorn warns about a bubble in technology and also the perilous political climate in the US.

Source: pinterest.com

Source: pinterest.com

REUTERSBrendan McDermid Hedge-fund manager David Einhorn who runs Greenlight Capital says were seeing another tech bubble CNBC reported citing his funds quarterly investor letter. In his latest Q3 2020 Letter David Einhorn discusses why he believes September 2 2020 was the top and the bubble has already popped which means investor sentiment is in the process of shifting from greed to complacency. Its been a difficult road for. David Einhorns Greenlight Capital has given up on its technology shorts covering its infamous bubble basket at a moderate loss according to its fourth-quarter letter. Our working hypothesis which might be disproven is that.

Source: businessinsider.com

Einhorn who runs Greenlight Capital wrote in a letter we are in the midst of an enormous tech bubble but noted September 2 2020 was the top and the bubble has already popped Einhorn said hes adjusted his portfolios short-book with bets that stock prices will fall by adding a fresh bubble basket of mostly second-tier companies and. Einhorn warns about enormous tech bubble in latest letter. In a letter to his investors sent today Einhorn called the current market environment regarding technology companies the second tech bubble in 15 years David Einhorn Just Cried Bubble And Let. Our working hypothesis which might be disproven is that September 2 2020 was the top and the bubble has already popped he wrote in. And Netflix IncA spokesman for the firm declined to.

Source: pinterest.com

Source: pinterest.com

Greenlights October return pared this years losses to 96 according to an investor update viewed by Bloomberg. A spokesman for the firm declined to comment. David Einhorns Greenlight Capital was up 59 for the third quarter compared to the SP 500s 89 gain. Bloomberg – Technology stocks are in an enormous bubble Greenlight Capitals David Einhorn said in a letter to investors. In early 2016 he prematurely identified what we thought was a bubble he wrote in the letter.

Source: pinterest.com

Source: pinterest.com

Its been a difficult road for. Hedge fund manager David Einhorn who famously called out Lehman Brothers before its 2008 collapse wrote in a quarterly letter to clients this week that. Our working hypothesis which might be disproven is that September 2 2020 was the top and the bubble has already popped he wrote in. It was Einhorns fourth straight positive month. Einhorn who runs Greenlight Capital wrote in a letter we are in the midst of an enormous tech bubble but noted September 2 2020 was the top and the bubble has already popped.

Source: ar.pinterest.com

Source: ar.pinterest.com

This isnt the first time Einhorn has flagged a tech bubble. The fund is down 161 through September and has been trying to recoup losses. Our working hypothesis which might be disproven is that. This isnt the first time Einhorn has flagged a tech bubble. In a letter to his investors sent today Einhorn called the current market environment regarding technology companies the second tech bubble in 15 years David Einhorn Just Cried Bubble And Let.

Source: pinterest.com

Source: pinterest.com

We are now in the midst of an enormous tech bubble Einhorn told investors in a letter this week saying he had added a set of bets against mostly second-tier. This isnt the first time Einhorn has flagged a tech bubble. Our working hypothesis which might be disproven is that September 2 2020 was the top and the bubble has already popped he wrote in. David Einhorns Greenlight Capital has given up on its technology shorts covering its infamous bubble basket at a moderate loss according to its fourth-quarter letter. Its been a difficult road for Greenlight recently.

Source: pinterest.com

Source: pinterest.com

Its been a difficult road for Greenlight recently. The fund is down 161 through September and has been trying to recoup losses. As for the question of sanity we are now in the midst of an enormous tech bubble. Einhorn a hedge fund manager at Greenlight Capital warned of a second tech bubble in his first quarter investor letter read in full here. This isnt the first time Einhorn has flagged a tech bubble.

Source: pinterest.com

Source: pinterest.com

Einhorn who runs Greenlight Capital wrote in a letter we are in the midst of an enormous tech bubble but noted September 2 2020 was the top and the bubble has already popped Einhorn said hes adjusted his portfolios short-book with bets that stock prices will fall by adding a fresh bubble basket of mostly second-tier companies and. Greenlight Capitals David Einhorn warns about a bubble in technology and also the perilous political climate in the US. Einhorn warns about enormous tech bubble in latest letter. This isnt the first time Einhorn has flagged a tech bubble. Our working hypothesis which might be disproven is that September 2 2020 was the top and the bubble has already popped he wrote in.

Source: pinterest.com

Source: pinterest.com

Its been a difficult road for. In early 2016 he prematurely identified what we thought was a bubble he wrote in the letter. In his latest Q3 2020 Letter David Einhorn discusses why he believes September 2 2020 was the top and the bubble has already popped which means investor sentiment is in the process of shifting from greed to complacency. Our working hypothesis which might be disproven is that September 2 2020 was the top and the bubble has already popped he wrote in. David Einhorns Greenlight Capital was up 59 for the third quarter compared to the SP 500s 89 gain.

Source: seekingalpha.com

Source: seekingalpha.com

Greenlights October return pared this years losses to 96 according to an investor update viewed by Bloomberg. Its been a difficult road for Greenlight recently. It was Einhorns fourth straight positive month. REUTERSBrendan McDermid Hedge-fund manager David Einhorn who runs Greenlight Capital says were seeing another tech bubble CNBC reported citing his funds quarterly investor letter. Einhorn who runs Greenlight Capital wrote in a letter we are in the midst of an enormous tech bubble but noted September 2 2020 was the top and the bubble has already popped.

Source: pinterest.com

Source: pinterest.com

In his latest Q3 2020 Letter David Einhorn discusses why he believes September 2 2020 was the top and the bubble has already popped which means investor sentiment is in the process of shifting from greed to complacency. This isnt the first time Einhorn has flagged a tech bubble. The fund is down 161 through September and has been trying to recoup losses. And Netflix IncA spokesman for the firm declined to. As for the question of sanity we are now in the midst of an enormous tech bubble.

Source: pinterest.com

Source: pinterest.com

The fund is down 161 through September and has been trying to recoup losses. Heres an excerpt from the letter. We are now in the midst of an enormous tech bubble Einhorn told investors in a letter this week saying he had added a set of bets against mostly second-tier. Its been a difficult road for Greenlight recently. In his latest Q3 2020 Letter David Einhorn discusses why he believes September 2 2020 was the top and the bubble has already popped which means investor sentiment is in the process of shifting from greed to complacency.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title einhorn tech bubble letter by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 15+ Southeast asia tech unicorns info

- 16++ Big tech podcast ideas in 2021

- 11++ Tech area home info

- 13++ Opentable tech uk blog info

- 15++ Tech huawei blog information

- 13++ What does a technology evangelist do ideas in 2021

- 18++ Big tech net zero ideas

- 16++ Tech corp questions ideas

- 11+ Tech entrepreneur csc ideas in 2021

- 17+ Technical guruji net worth ideas