18++ Japan tech bubble ideas

Home » tech Info » 18++ Japan tech bubble ideasYour Japan tech bubble images are available in this site. Japan tech bubble are a topic that is being searched for and liked by netizens now. You can Get the Japan tech bubble files here. Get all free photos.

If you’re searching for japan tech bubble pictures information related to the japan tech bubble topic, you have visit the right site. Our site frequently gives you hints for viewing the maximum quality video and picture content, please kindly hunt and find more informative video content and images that match your interests.

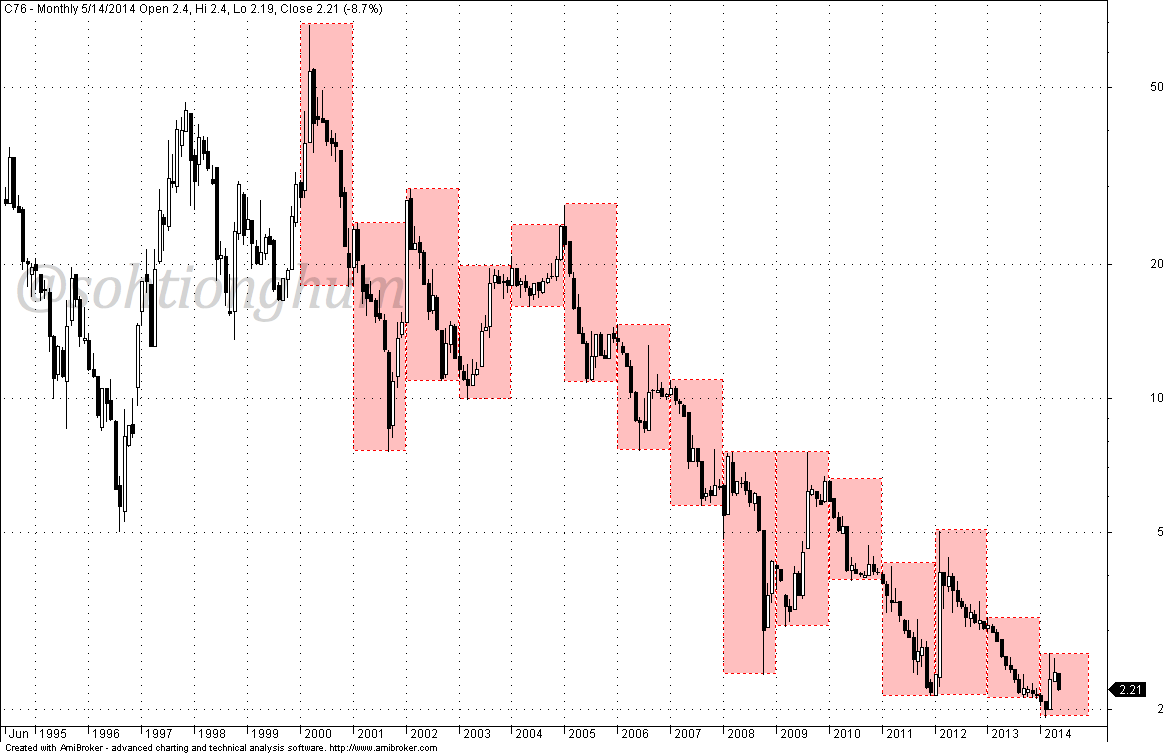

Japan Tech Bubble. 5 Stages of a Bubble. Or as I prefer to call it the jam tomorrow bubble. The current bubble in a select group of technology stocks compares to the real estate bubble in Japan in the late 1980s. Japans economic bubble of the 1980s is a classic example.

Famous Asset Bubbles Bitcoin Chart South Sea Bubble How To Get Rich From pinterest.com

Famous Asset Bubbles Bitcoin Chart South Sea Bubble How To Get Rich From pinterest.com

These stages also outline the basic pattern of a bubble. As this spread has widened we have rotated more of the portfolio into value shares and today they represent 75 of the Strategy. In Stage 1 a displacement occurs when investors get enamored by a new paradigm such as a new technology. The NASDAQ rose at an alarming pace reaching almost 2200 points in January of 1999. In 2000 at the height of the dot-com bubble and for the 200-day period ending March 27 tech. It is a privilege as a market historian to experience a major stock bubble once again.

The tech bubble is part of the long duration bubble.

Large-cap growth and technology stocks plunged while value stocks had gains. The dotcom bubble lasted about two years between 1998 and 2000. The Technology Bubble Bursts. Prime Minister Shinzo Abe doubled Japans stimulus measures as he looked to deliver on his bold promise to keep businesses. In Stage 1 a displacement occurs when investors get enamored by a new paradigm such as a new technology. The tech-focused Nasdaq Composite Index fell -390 in 2000 while the.

Source: pinterest.com

Source: pinterest.com

Japan in 1989 the 2000 Tech bubble the 2008 housing and mortgage crisis and now the current bubble these are the four most significant and gripping investment events of my life. Recall that the Japan asset price bubble. According to Economist Hyman PMinsky he identified five stages in a typical market cycle. Japan in 1989 the 2000 Tech bubble the 2008 housing and mortgage crisis and now the current bubble - these are the four most significant and gripping investment events of my life. This is built on the belief that money tomorrow is worth pretty much the same as.

Source: pinterest.com

Source: pinterest.com

The yens 50 surge in the early 1980s triggered a Japanese recession in 1986 and to counter it the government ushered in a. Japan in 1989 the 2000 Tech bubble the 2008 housing and mortgage crisis and now the current bubble - these are the four most significant and gripping investment events of my life. Japan in 1989 the 2000 Tech bubble the 2008 housing and mortgage crisis and now the current bubble these are the four most significant and gripping investment events of my life. The tech bubble is part of the long duration bubble. One bubble that persisted a bit longer and may be closer to what big cap tech stocks are doing today was the Japan bubble of the 1980s.

Source: pinterest.com

Source: pinterest.com

The yens 50 surge in the early 1980s triggered a Japanese recession in 1986 and to counter it the government ushered in a. Recall that the Japan asset price bubble. Prime Minister Shinzo Abe doubled Japans stimulus measures as he looked to deliver on his bold promise to keep businesses. The dotcom bubble lasted about two years between 1998 and 2000. Large-cap growth and technology stocks plunged while value stocks had gains.

Source: pinterest.com

Source: pinterest.com

The tech bubble is part of the long duration bubble. The equity led dot-com bubble of the late 1990s was similar but its impact was less catastrophic. The dotcom bubble lasted about two years between 1998 and 2000. Japan in 1989 the 2000 Tech bubble the 2008 housing and mortgage crisis and now the current bubble - these are the four most significant and gripping investment events of my life. The time between 1995 and 1997 is considered to be the pre-bubble period when things started to heat up in the industry.

Source: id.pinterest.com

Source: id.pinterest.com

The current bubble in a select group of technology stocks compares to the real estate bubble in Japan in the late 1980s. So if you are looking for a parallel to Japans Nikkei in the 1980s the US in the 1990s ahead of the tech bubble crash is very good. The business was shuttered after Japans tech bubble burst in the wake of the Horiemon scandal of 2006. One bubble that persisted a bit longer and may be closer to what big cap tech stocks are doing today was the Japan bubble of the 1980s. The equity led dot-com bubble of the late 1990s was similar but its impact was less catastrophic.

Source: pinterest.com

Source: pinterest.com

As this spread has widened we have rotated more of the portfolio into value shares and today they represent 75 of the Strategy. In the US in the 1990s teachers and policemen left their jobs to become day traders. Investor psychology at the moment also leads Hofrichter to believe stocks are in a bubble right now. Tech IPOs usually had returns in excess of 100 percent on the first day. The yens 50 surge in the early 1980s triggered a Japanese recession in 1986 and to counter it the government ushered in a.

Source: pinterest.com

Source: pinterest.com

According to Economist Hyman PMinsky he identified five stages in a typical market cycle. The dotcom bubble lasted about two years between 1998 and 2000. The business was shuttered after Japans tech bubble burst in the wake of the Horiemon scandal of 2006. As this spread has widened we have rotated more of the portfolio into value shares and today they represent 75 of the Strategy. Most of the time in more normal markets you show up for work and do your job.

Source: pinterest.com

Source: pinterest.com

This is built on the belief that money tomorrow is worth pretty much the same as. The tech-focused Nasdaq Composite Index fell -390 in 2000 while the. The business was shuttered after Japans tech bubble burst in the wake of the Horiemon scandal of 2006. These stages also outline the basic pattern of a bubble. Take the US tech bubble of the 1990s add the subsequent real estate bubble of the 2000s multiply by two and you have a good approximation of the events leading to Japans.

Source: in.pinterest.com

Source: in.pinterest.com

The dotcom bubble lasted about two years between 1998 and 2000. The tech-focused Nasdaq Composite Index fell -390 in 2000 while the. Investor psychology at the moment also leads Hofrichter to believe stocks are in a bubble right now. The time between 1995 and 1997 is considered to be the pre-bubble period when things started to heat up in the industry. The equity led dot-com bubble of the late 1990s was similar but its impact was less catastrophic.

Source: pinterest.com

Source: pinterest.com

To revisit our favourite chart valuation spreads in Japan are now close to the extremes of the tech bubble. Or as I prefer to call it the jam tomorrow bubble. He said there is too much optimism around the degree of economic growth in the years ahead evidenced by the bullish earnings expectation revisions for some tech firms over the next three-to-five years. Japan in 1989 the 2000 Tech bubble the 2008 housing and mortgage crisis and now the current bubble these are the four most significant and gripping investment events of my life. Take the US tech bubble of the 1990s add the subsequent real estate bubble of the 2000s multiply by two and you have a good approximation of the events leading to Japans.

Source: in.pinterest.com

Source: in.pinterest.com

Japans economic bubble of the 1980s is a classic example. As this spread has widened we have rotated more of the portfolio into value shares and today they represent 75 of the Strategy. Most of the time in more normal markets you show up for work and do your job. TVS was dormant until it was was revived three and a half years ago. So if you are looking for a parallel to Japans Nikkei in the 1980s the US in the 1990s ahead of the tech bubble crash is very good.

Source: pinterest.com

Source: pinterest.com

He said there is too much optimism around the degree of economic growth in the years ahead evidenced by the bullish earnings expectation revisions for some tech firms over the next three-to-five years. Or as I prefer to call it the jam tomorrow bubble. He said there is too much optimism around the degree of economic growth in the years ahead evidenced by the bullish earnings expectation revisions for some tech firms over the next three-to-five years. Japan in 1989 the 2000 Tech bubble the 2008 housing and mortgage crisis and now the current bubble - these are the four most significant and gripping investment events of my life. These stages also outline the basic pattern of a bubble.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title japan tech bubble by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 15+ Southeast asia tech unicorns info

- 16++ Big tech podcast ideas in 2021

- 11++ Tech area home info

- 13++ Opentable tech uk blog info

- 15++ Tech huawei blog information

- 13++ What does a technology evangelist do ideas in 2021

- 18++ Big tech net zero ideas

- 16++ Tech corp questions ideas

- 11+ Tech entrepreneur csc ideas in 2021

- 17+ Technical guruji net worth ideas