19++ Tech bubble investopedia ideas

Home » tech Info » 19++ Tech bubble investopedia ideasYour Tech bubble investopedia images are ready in this website. Tech bubble investopedia are a topic that is being searched for and liked by netizens today. You can Get the Tech bubble investopedia files here. Find and Download all free vectors.

If you’re searching for tech bubble investopedia pictures information linked to the tech bubble investopedia interest, you have come to the ideal site. Our website frequently gives you hints for refferencing the maximum quality video and image content, please kindly surf and find more informative video articles and graphics that fit your interests.

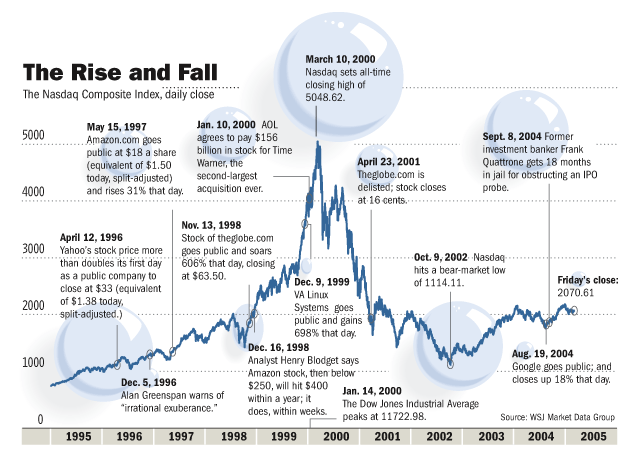

Tech Bubble Investopedia. The dot com bubble was a stock market bubble that burst with ravaging effects in 2001. Venture Capital Investments 1995-2017. These examples of fintech bubble babble contain questionable assumptions. On October 9 2002 the NASDAQ bottomed at 111411 having lost 78 of its value.

Mega Nasdaq Bubble Theo Trade Nasdaq Free Education Tech Stocks From pinterest.com

Mega Nasdaq Bubble Theo Trade Nasdaq Free Education Tech Stocks From pinterest.com

That topic has already been exhaustively discussed by The New York Times Financial Times and even Investopedia. Tech bubble refers to a pronounced and unsustainable market rise attributed to increased speculation in technology stocks. Investopedia noted that the technology-dominated NASDAQ Index rose from under 1000 to more than 5000 between the years 1995 and 2000 That equates to. A tech bubble is highlighted by rapid share price growth and high valuations based on standard metrics like priceearnings ratio or pricesales. Many businesses and companies invested in online start ups even though the stock market held no proof. Investors ran for the exits and once-high-flying Internet stocks started to go broke.

The dot com bubble was a stock market bubble that burst with ravaging effects in 2001.

With revenue of 65 billion in 2016 it still registered a net loss of 28. The dot com bubble was a stock market bubble that burst with ravaging effects in 2001. In the past two decades weve experienced two gigantic asset bubbles first in tech stocks then in housing. Uber the highest-valued private technology company has rapidly growing revenue but remains highly unprofitable. Before we continue its necessary to quickly clarify that the tech bubble herein referred to is not the one about tech stocks price movement. A pronounced and unsustainable market rise attributed to increased speculation in technology stocks.

Source: pinterest.com

Source: pinterest.com

Investors ran for the exits and once-high-flying Internet stocks started to go broke. Before we continue its necessary to quickly clarify that the tech bubble herein referred to is not the one about tech stocks price movement. Investors ran for the exits and once-high-flying Internet stocks started to go broke. The Tech Bubble and the Housing Bubble. This bubble was created by the rise of Internet sites and tech in general.

Source: pinterest.com

Source: pinterest.com

Tech bubble refers to a pronounced and unsustainable market rise attributed to increased speculation in technology stocks. This bubble was created by the rise of Internet sites and tech in general. The dot com bubble was a stock market bubble that burst with ravaging effects in 2001. Venture Capital Investments 1995-2017. The Tech Bubble and the Housing Bubble.

Source: medium.com

Source: medium.com

Venture Capital Investments 1995-2017. A pronounced and unsustainable market rise attributed to increased speculation in technology stocks. Both were driven by unbridled financial engineering. The dotcom bubble was a rapid rise in US. Uber the highest-valued private technology company has rapidly growing revenue but remains highly unprofitable.

Source: pinterest.com

Source: pinterest.com

A financial bubble also known as an economic bubble or an asset bubble is characterized by a fast large climb in the market price of different assets. Investopedia defines a tech bubble as a pronounced and unsustainable market rise attributed to increased speculation in technology stocks. Investopedia noted that the technology-dominated NASDAQ Index rose from under 1000 to more than 5000 between the years 1995 and 2000 That equates to. A tech bubble is highlighted by rapid share price growth and high valuations based on standard metrics like priceearnings ratio or pricesales. These examples of fintech bubble babble contain questionable assumptions.

Source: investopedia.com

Source: investopedia.com

A tech bubble is highlighted by rapid share price growth and high valuations based on standard metrics like priceearnings ratio or pricesales. According to Investopedia a tech bubble is. The dot com bubble was a stock market bubble that burst with ravaging effects in 2001. A financial bubble also known as an economic bubble or an asset bubble is characterized by a fast large climb in the market price of different assets. The dotcom bubble was a rapid rise in US.

Source: investopedia.com

Source: investopedia.com

The dot-com bubble also known as the dot-com boom the tech bubble and the Internet bubble was a historic economic bubble and period of excessive speculation that occurred roughly from 1995 to 2000 a period of extreme growth in the usage and adaptation of the Internet. The dotcom bubble was a rapid rise in US. Uber the highest-valued private technology company has rapidly growing revenue but remains highly unprofitable. Many businesses and companies invested in online start ups even though the stock market held no proof. The dotcom bubble started growing in the late 90s as access to the internet expanded and computing took on an increasingly important part in peoples daily lives.

Source: investopedia.com

Source: investopedia.com

A financial bubble also known as an economic bubble or an asset bubble is characterized by a fast large climb in the market price of different assets. A tech bubble is highlighted by rapid share price growth and high valuations based on standard metrics like priceearnings ratio or pricesales. This bubble was created by the rise of Internet sites and tech in general. According to Investopedia a tech bubble is. On March 10 2000 the NASDAQ hit an all-time intra-day high of 513252.

Source: investopedia.com

Source: investopedia.com

On October 9 2002 the NASDAQ bottomed at 111411 having lost 78 of its value. A tech bubble is highlighted by rapid share price growth and high valuations based on standard metrics like priceearnings ratio or pricesales. The September 11 2001 terrorist attacks put an end to a decade of growth. Many businesses and companies invested in online start ups even though the stock market held no proof. The dotcom bubble was a rapid rise in US.

Source: pinterest.com

Source: pinterest.com

The FT articles data source only looked at capital marketnot retailstartups making the claim of a. On October 9 2002 the NASDAQ bottomed at 111411 having lost 78 of its value. With revenue of 65 billion in 2016 it still registered a net loss of 28. Investopedia noted that the technology-dominated NASDAQ Index rose from under 1000 to more than 5000 between the years 1995 and 2000 That equates to. On March 10 2000 the NASDAQ hit an all-time intra-day high of 513252.

Source: investopedia.com

Source: investopedia.com

This bubble was created by the rise of Internet sites and tech in general. The dot com bubble was a stock market bubble that burst with ravaging effects in 2001. The September 11 2001 terrorist attacks put an end to a decade of growth. Investopedia noted that the technology-dominated NASDAQ Index rose from under 1000 to more than 5000 between the years 1995 and 2000 That equates to. If this is a tech bubble it is made of stronger stuff than the one that burst at the turn of the millennium.

Source: investopedia.com

Source: investopedia.com

On March 10 2000 the NASDAQ hit an all-time intra-day high of 513252. On October 9 2002 the NASDAQ bottomed at 111411 having lost 78 of its value. Investors ran for the exits and once-high-flying Internet stocks started to go broke. A pronounced and unsustainable market rise attributed to increased speculation in technology stocks. The dotcom bubble was a rapid rise in US.

Source: investopedia.com

Source: investopedia.com

Investopedia noted that the technology-dominated NASDAQ Index rose from under 1000 to more than 5000 between the years 1995 and 2000 That equates to. The dotcom bubble was a rapid rise in US. The FT articles data source only looked at capital marketnot retailstartups making the claim of a. Both were driven by unbridled financial engineering. Venture Capital Investments 1995-2017.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title tech bubble investopedia by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 15+ Southeast asia tech unicorns info

- 16++ Big tech podcast ideas in 2021

- 11++ Tech area home info

- 13++ Opentable tech uk blog info

- 15++ Tech huawei blog information

- 13++ What does a technology evangelist do ideas in 2021

- 18++ Big tech net zero ideas

- 16++ Tech corp questions ideas

- 11+ Tech entrepreneur csc ideas in 2021

- 17+ Technical guruji net worth ideas