13+ Tech companies with low debt info

Home » tech Info » 13+ Tech companies with low debt infoYour Tech companies with low debt images are ready in this website. Tech companies with low debt are a topic that is being searched for and liked by netizens today. You can Download the Tech companies with low debt files here. Find and Download all royalty-free vectors.

If you’re looking for tech companies with low debt pictures information connected with to the tech companies with low debt interest, you have come to the ideal site. Our site frequently provides you with suggestions for downloading the maximum quality video and picture content, please kindly surf and find more enlightening video articles and graphics that match your interests.

Tech Companies With Low Debt. This includes only debt not other liabilities such as accounts payable income tax payable accrued payroll or the catch-all other liabilities. Perhaps we should applaud companies for taking advantage of low rates to grow their businesses. Cash-fortified low debt Some industry-leading companies have been hoarding cash. Among its brands are Teva UGG Hoka Sanuk.

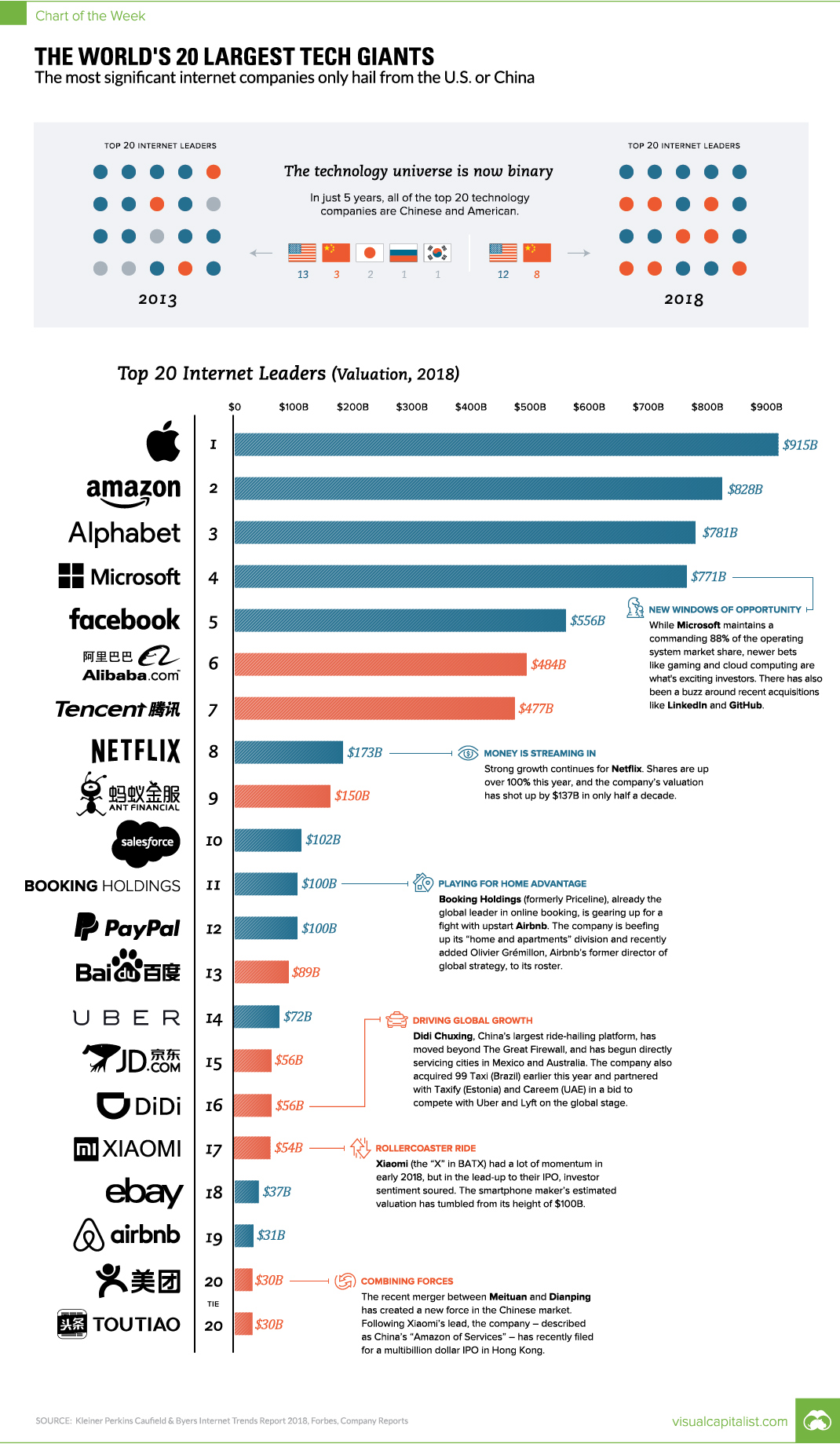

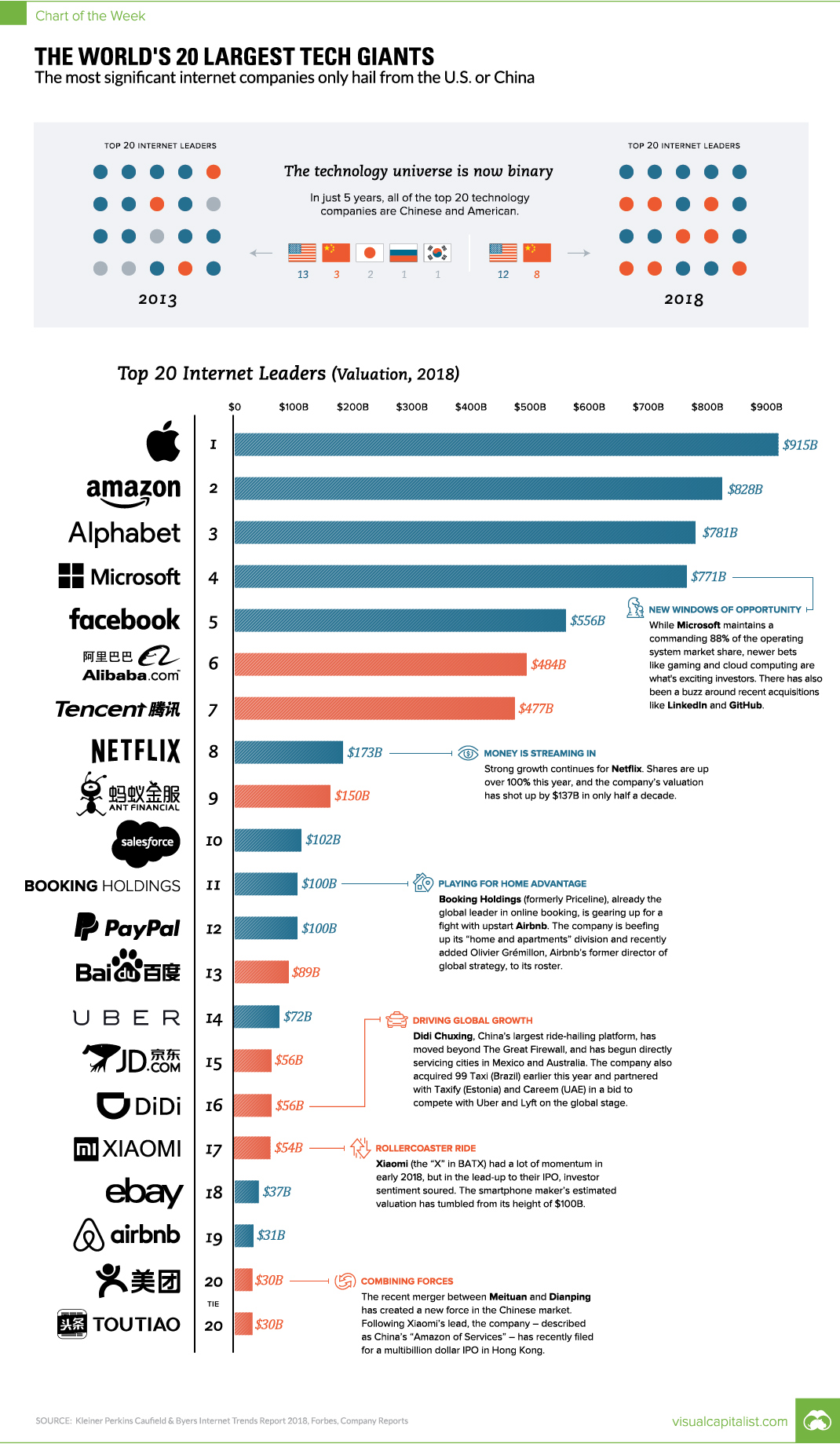

Chart Visualizing The World S 20 Largest Tech Giants From visualcapitalist.com

Chart Visualizing The World S 20 Largest Tech Giants From visualcapitalist.com

Based in Goleta California Deckers makes shoes boots and clothes. Interest only for the first. But not taking advantage of low rates doesnt mean the company is bad. Sprint has 398 billion. Consider that four information-age bellwethersApple AAPL Microsoft MSFT Google GOOG and Cisco CSCO. Companies in the SP 500 reported a 10 increase in long-term debt.

And low rates explain in part why many companies are increasing their long-term debt.

A company which satisfies the above 3 formulas are as good as debt free companies. Reserves greater than the total loan amount the company. A ratio lower than 1 is considered favorable since that indicates a company is relying more on equity than on debt. And low rates explain in part why many companies are increasing their long-term debt. Price to book value may between 1-5. Perhaps we should applaud companies for taking advantage of low rates to grow their businesses.

Source: pinterest.com

Source: pinterest.com

Cash-fortified low debt Some industry-leading companies have been hoarding cash. With its IBD Composite Rating of 93 the company. Consider that four information-age bellwethersApple AAPL Microsoft MSFT Google GOOG and Cisco CSCO. A powerful combo of technical and fundamental analysis to find out dividend paying largemid cap cos with growing net sales yearly eps and recovering from their 52 week low and presently trading higher than the previous months high indicating a range breakout. And low rates explain in part why many companies are increasing their long-term debt.

Source: visualcapitalist.com

Source: visualcapitalist.com

The average DE ratio among SP 500 companies is approximately 15. They may not be a zero debt company but their debt level is so low that they can still be treated as a debt free company. Corcept has zero long-term debt none and the current ratio sits at 79. Their priceearnings ratio is 1334 which is relatively low for this sector and given that the SP 500s pe is 19. I remember meeting with one of our investors.

Source: in.pinterest.com

Source: in.pinterest.com

Another example of a highly rated IBD stock with no long-term debt is cosmetics seller Ulta. Recovery from 52 week low 1 month ago - Scan description. Grasim cuts debt VSF and Cement to Steady the Ship in FY22 ICICI BANK LTD. Another year of runway would give another year of traction in the marketplace. T-Mobile has 374 billion in short-term and long-term debt.

Source: ar.pinterest.com

Source: ar.pinterest.com

Cash-fortified low debt Some industry-leading companies have been hoarding cash. They may not be a zero debt company but their debt level is so low that they can still be treated as a debt free company. Based in Goleta California Deckers makes shoes boots and clothes. Cash-fortified low debt Some industry-leading companies have been hoarding cash. Corcept has zero long-term debt none and the current ratio sits at 79.

Source: pinterest.com

Source: pinterest.com

Search switching it onoff. The average DE ratio among SP 500 companies is approximately 15. Their priceearnings ratio is 1334 which is relatively low for this sector and given that the SP 500s pe is 19. Among its brands are Teva UGG Hoka Sanuk. - 532174 - Compliances-Reg.

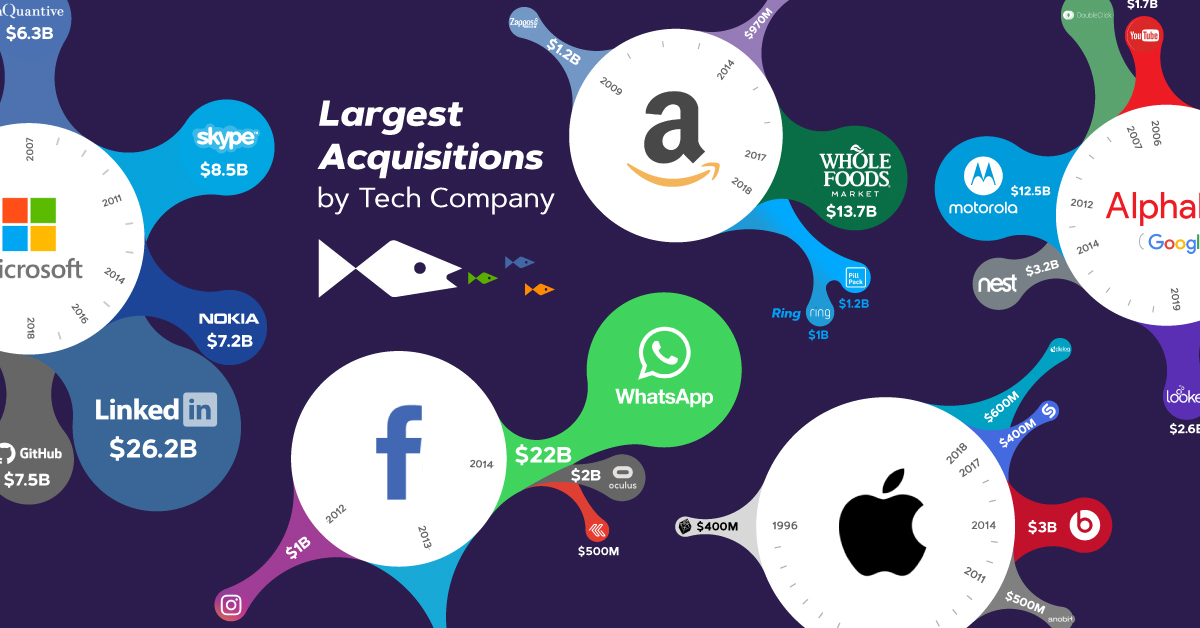

Source: visualcapitalist.com

Source: visualcapitalist.com

But not taking advantage of low rates doesnt mean the company is bad. - 532174 - Compliances-Reg. Companies in the SP 500 reported a 10 increase in long-term debt. A ratio lower than 1 is considered favorable since that indicates a company is relying more on equity than on debt. With a return on equity close to 28 Deckers Outdoor DECK looks appealing.

Source: id.pinterest.com

Source: id.pinterest.com

Companies in the SP 500 reported a 10 increase in long-term debt. Another year of runway would give another year of traction in the marketplace. 39 3 - Details of Loss of Certificate Duplicate. Reserves greater than the total loan amount the company. T-Mobile has 374 billion in short-term and long-term debt.

Source: id.pinterest.com

Source: id.pinterest.com

Grasim cuts debt VSF and Cement to Steady the Ship in FY22 ICICI BANK LTD. Search switching it onoff. A powerful combo of technical and fundamental analysis to find out dividend paying largemid cap cos with growing net sales yearly eps and recovering from their 52 week low and presently trading higher than the previous months high indicating a range breakout. Another year of runway would give another year of traction in the marketplace. Their priceearnings ratio is 1334 which is relatively low for this sector and given that the SP 500s pe is 19.

Source: pinterest.com

Source: pinterest.com

Google holding company Alphabet has a very low debt-to-equity ratio. Combined they will have 772 billion in debt. A ratio lower than 1 is considered favorable since that indicates a company is relying more on equity than on debt. Cash-fortified low debt Some industry-leading companies have been hoarding cash. A company which satisfies the above 3 formulas are as good as debt free companies.

Source: pinterest.com

Source: pinterest.com

Example of Debt Analysis of a Company. Price to book value may between 1-5. Recovery from 52 week low 1 month ago - Scan description. - 532174 - Compliances-Reg. Interest only for the first.

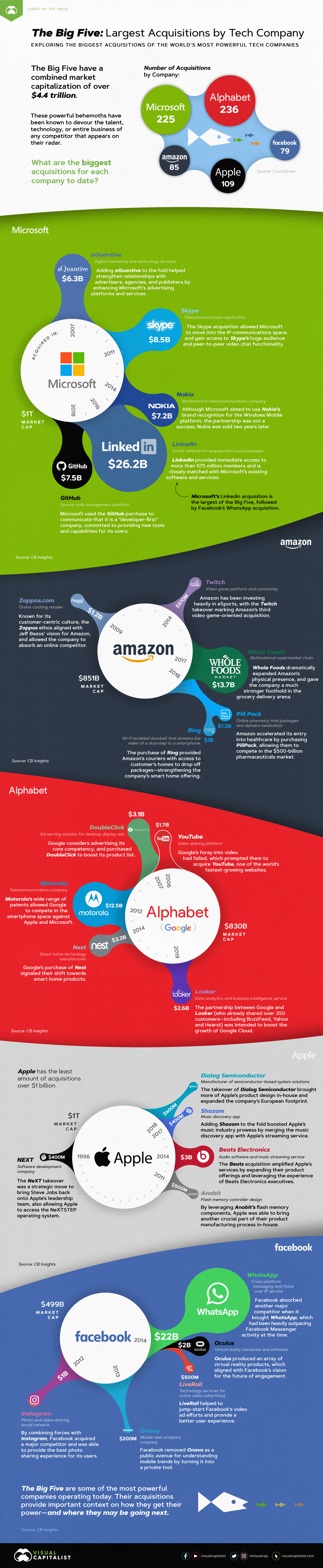

Source: visualcapitalist.com

Source: visualcapitalist.com

- 532174 - Compliances-Reg. Corcept has zero long-term debt none and the current ratio sits at 79. Another example of a highly rated IBD stock with no long-term debt is cosmetics seller Ulta. Consider that four information-age bellwethersApple AAPL Microsoft MSFT Google GOOG and Cisco CSCO. And the terms were unbelievably good.

Source: pinterest.com

Source: pinterest.com

Cash-fortified low debt Some industry-leading companies have been hoarding cash. Among its brands are Teva UGG Hoka Sanuk. This includes only debt not other liabilities such as accounts payable income tax payable accrued payroll or the catch-all other liabilities. Consider that four information-age bellwethersApple AAPL Microsoft MSFT Google GOOG and Cisco CSCO. Example of Debt Analysis of a Company.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title tech companies with low debt by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 15+ Southeast asia tech unicorns info

- 16++ Big tech podcast ideas in 2021

- 11++ Tech area home info

- 13++ Opentable tech uk blog info

- 15++ Tech huawei blog information

- 13++ What does a technology evangelist do ideas in 2021

- 18++ Big tech net zero ideas

- 16++ Tech corp questions ideas

- 11+ Tech entrepreneur csc ideas in 2021

- 17+ Technical guruji net worth ideas