19+ Tech company ebitda multiple ideas

Home » tech Info » 19+ Tech company ebitda multiple ideasYour Tech company ebitda multiple images are ready. Tech company ebitda multiple are a topic that is being searched for and liked by netizens today. You can Find and Download the Tech company ebitda multiple files here. Download all royalty-free vectors.

If you’re looking for tech company ebitda multiple pictures information connected with to the tech company ebitda multiple topic, you have pay a visit to the ideal blog. Our site always provides you with hints for downloading the maximum quality video and image content, please kindly surf and locate more enlightening video articles and graphics that fit your interests.

Tech Company Ebitda Multiple. Over 12 times EBITDA per share to be exact. This is higher than other companies within the Consumer Durables industry meaning investors expect Apple to grow faster than its peers. What is the EBITDA Multiple. Apples EBITDA multiple of 1226 means investors are willing to pay a premium to buy shares of the company.

Ebitda Multiples By Industry Chart From howtoplanandsellabusiness.com

Ebitda Multiples By Industry Chart From howtoplanandsellabusiness.com

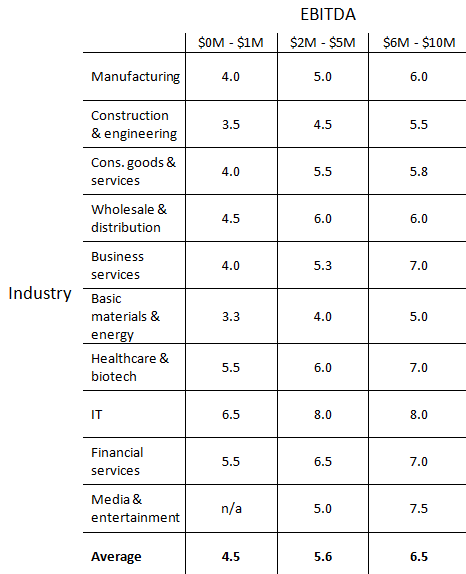

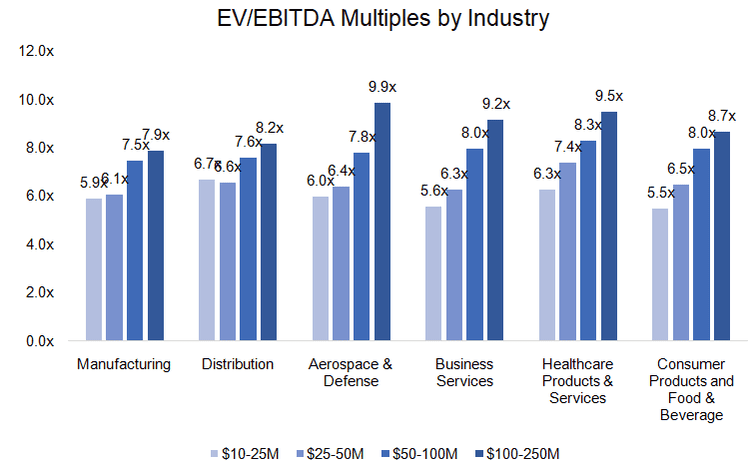

The EBITDA multiple for a specific sector is calculated by dividing the total enterprise value of all sector companies by the total sum of annual EBITDA of the companies. The EBITDA stated is for the most recent 12-month period. The highs in 2017 were 14x but a more normalized multiple historically has been around 9x. Business Valuation Resources recently published EBITDA multiples by industry from a study of over 30000. Ad See what you can research. Airport Operators Services.

Ad See what you can research.

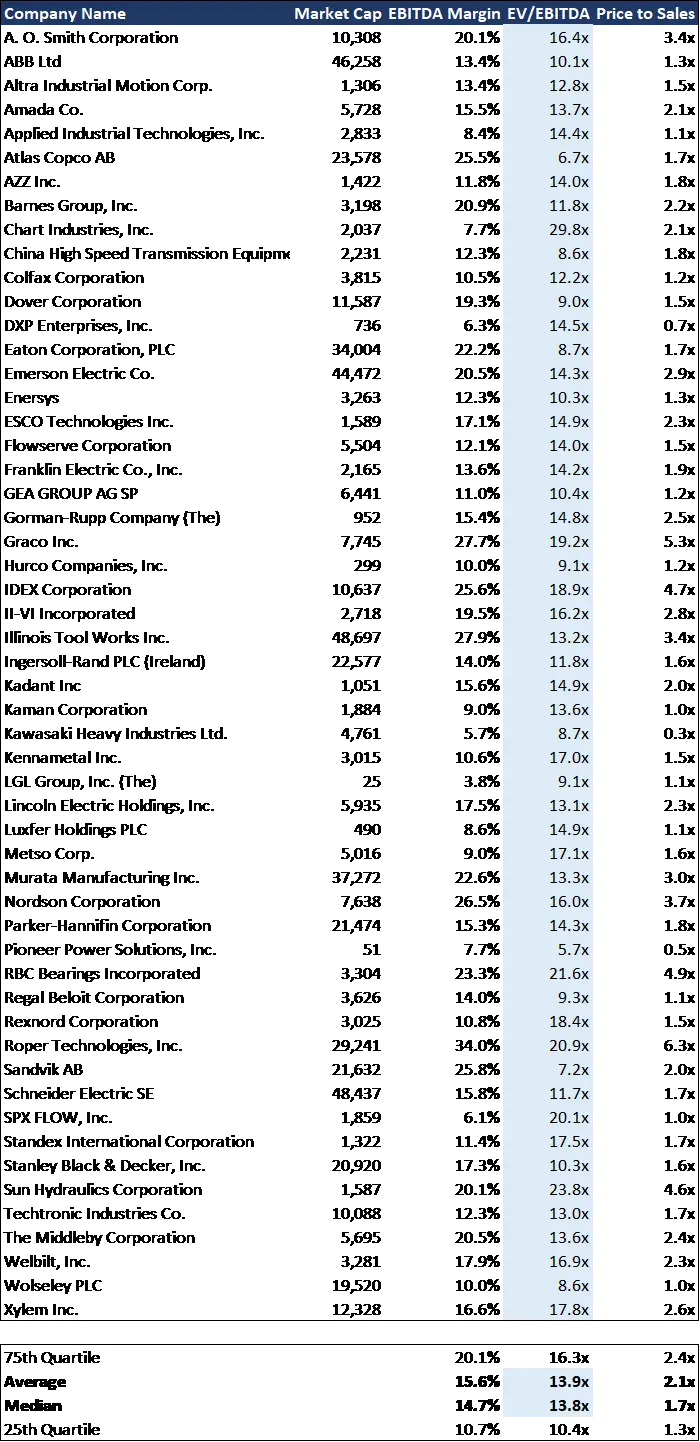

221 rows EBITDA Multiple. Business Valuation Resources recently published EBITDA multiples by industry from a study of over 30000. Traditional marketplace multiples vary widely. EBITDA Multiple1226 959B 782B. Advanced Medical Equipment Technology. Index indicating the enterprise value EV multiples against earnings before income tax and depreciation and amortization EBITDA In this analysis we determine EV as the total of market capitalization and interest-bearing liabilities.

Source: microcap.co

Source: microcap.co

Published by Statista Research Department Jan 18 2021 Worldwide the average value of enterprise value to earnings before interest tax depreciation and amortization EVEBITDA in the. The EBITDA stated is for the most recent 12-month period. Apparel Accessories Retailers. EBITDA Multiple1226 959B 782B. 98 rows Industry specific multiples are the techniques that demonstrate what business is worth.

Source: chinookadvisors.com

Source: chinookadvisors.com

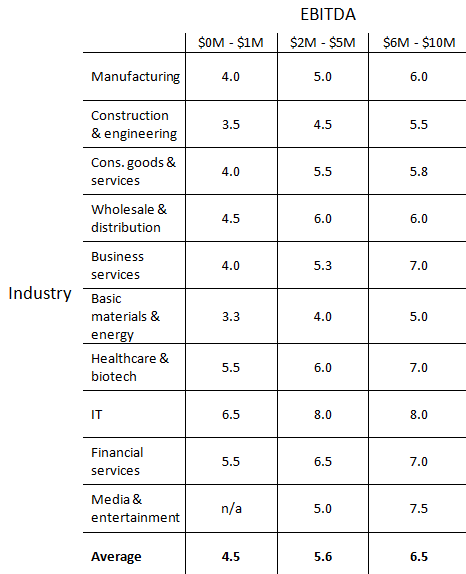

Interfinancial has reported January 2019 an average TMT EVEBITDA multiple of 137x and increasing where the ASX200 is running at 94x. Advanced Medical Equipment Technology. Apparel Accessories Retailers. Appliances Tools Housewares. Selling price divided by EBITDA earnings before interest taxes depreciation and amortization is a commonly used valuation multiple.

Source: microcap.co

Source: microcap.co

Come up with an industry average across peers for PE multiple EVEBITDA multiple revenue multiple and you can estimate how much your company is worth based on the industry benchmark. Ad See what you can research. Index indicating the enterprise value EV multiples against earnings before income tax and depreciation and amortization EBITDA In this analysis we determine EV as the total of market capitalization and interest-bearing liabilities. Snapchat is at 177x after falling from 40x in Q4 2016 and still lost nearly 1bln in EBITDA on 18bln of revenue. Come up with an industry average across peers for PE multiple EVEBITDA multiple revenue multiple and you can estimate how much your company is worth based on the industry benchmark.

Source: microcap.co

Source: microcap.co

What is the EBITDA Multiple. The EBITDA multiple for a specific sector is calculated by dividing the total enterprise value of all sector companies by the total sum of annual EBITDA of the companies. Apples EBITDA multiple of 1226 means investors are willing to pay a premium to buy shares of the company. Index indicating the enterprise value EV multiples against earnings before income tax and depreciation and amortization EBITDA In this analysis we determine EV as the total of market capitalization and interest-bearing liabilities. Snapchat is at 177x after falling from 40x in Q4 2016 and still lost nearly 1bln in EBITDA on 18bln of revenue.

Source: nashadvisory.com.au

Source: nashadvisory.com.au

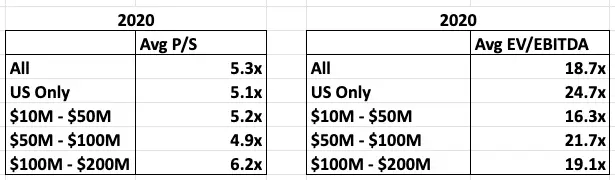

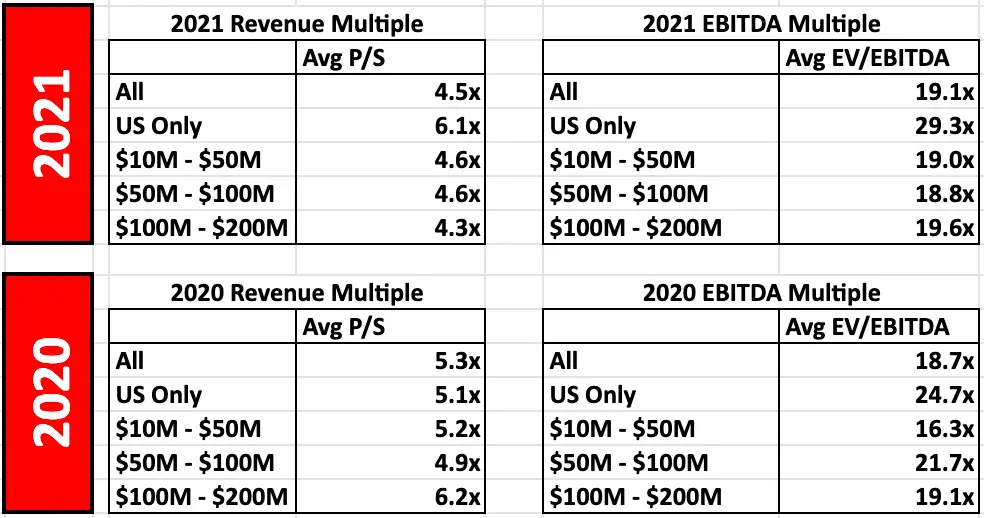

US Revenue and EBITDA in 2021 are higher For American tech companies revenue and EBITDA multiples both are higher in 2021 with average revenue multiple of 61x in 2021 compared to 51x in 2020 and average EBITDA multiple of 293x compared to 247x. Typically SaaS companies command higher multiples PE or EBITDA due to the nature of their business being sticky ie. Advanced Medical Equipment Technology. This is higher than other companies within the Consumer Durables industry meaning investors expect Apple to grow faster than its peers. The multiples on the table above are trailing twelve months meaning the last four quarters are used when earnings before interest taxes depreciation and amortization are calculated.

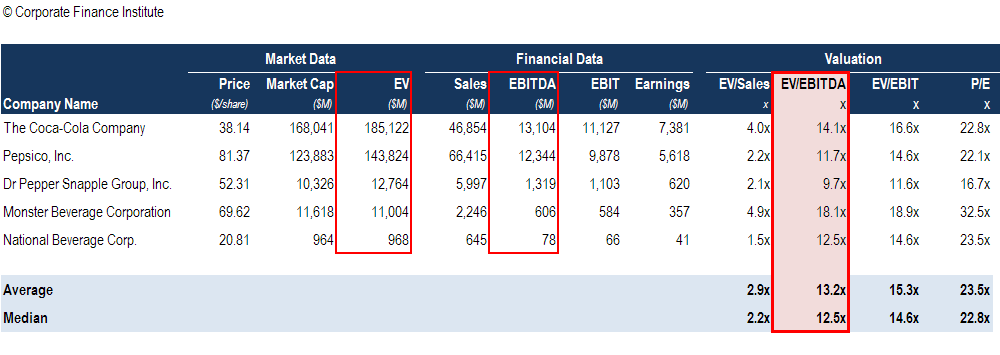

Source: corporatefinanceinstitute.com

Source: corporatefinanceinstitute.com

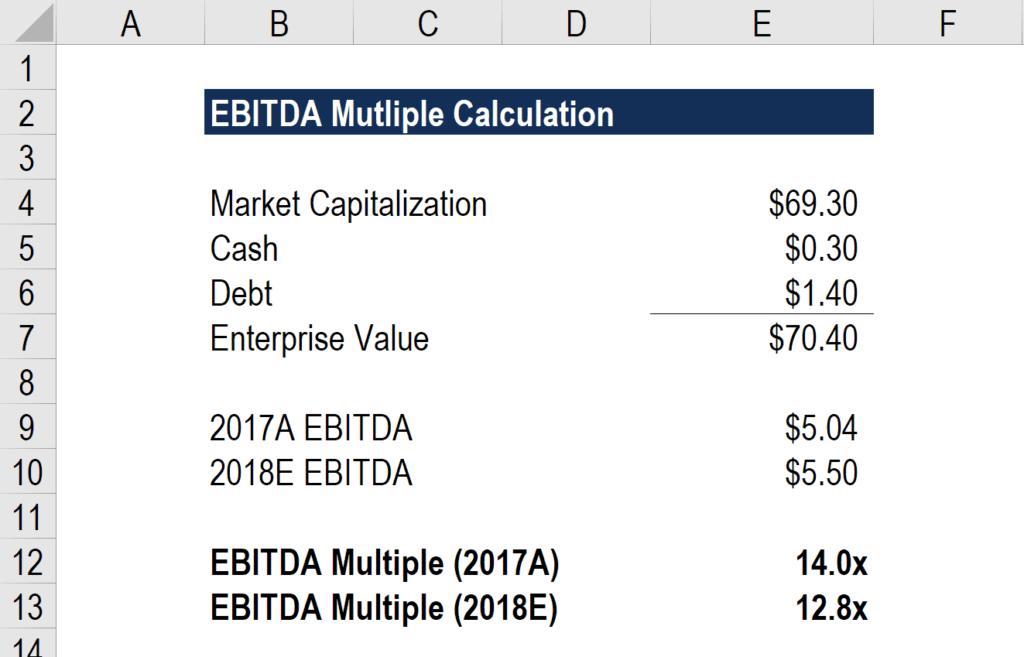

The multiples on the table above are trailing twelve months meaning the last four quarters are used when earnings before interest taxes depreciation and amortization are calculated. The highs in 2017 were 14x but a more normalized multiple historically has been around 9x. The EBITDA multiple is a financial ratio that compares a companys Enterprise Value Enterprise Value EV Enterprise Value or Firm Value is the entire value of a firm equal to its equity value plus net debt plus any minority interest to its annual EBITDA EBITDA EBITDA or Earnings Before Interest Tax Depreciation Amortization is a companys profits before any. Come up with an industry average across peers for PE multiple EVEBITDA multiple revenue multiple and you can estimate how much your company is worth based on the industry benchmark. Ad See what you can research.

Source: microcap.co

Source: microcap.co

Appliances Tools Housewares. There are also some big deals in the pipeline such as the 2b private equity MYOB takeover over which. The EBITDA multiple for a specific sector is calculated by dividing the total enterprise value of all sector companies by the total sum of annual EBITDA of the companies. Come up with an industry average across peers for PE multiple EVEBITDA multiple revenue multiple and you can estimate how much your company is worth based on the industry benchmark. Ad See what you can research.

Source: howtoplanandsellabusiness.com

Source: howtoplanandsellabusiness.com

The highs in 2017 were 14x but a more normalized multiple historically has been around 9x. Come up with an industry average across peers for PE multiple EVEBITDA multiple revenue multiple and you can estimate how much your company is worth based on the industry benchmark. This is higher than other companies within the Consumer Durables industry meaning investors expect Apple to grow faster than its peers. Published by Statista Research Department Jan 18 2021 Worldwide the average value of enterprise value to earnings before interest tax depreciation and amortization EVEBITDA in the. US Revenue and EBITDA in 2021 are higher For American tech companies revenue and EBITDA multiples both are higher in 2021 with average revenue multiple of 61x in 2021 compared to 51x in 2020 and average EBITDA multiple of 293x compared to 247x.

Source: corporatefinanceinstitute.com

Source: corporatefinanceinstitute.com

The EBITDA multiple is a financial ratio that compares a companys Enterprise Value Enterprise Value EV Enterprise Value or Firm Value is the entire value of a firm equal to its equity value plus net debt plus any minority interest to its annual EBITDA EBITDA EBITDA or Earnings Before Interest Tax Depreciation Amortization is a companys profits before any. The EBITDA multiple for a specific sector is calculated by dividing the total enterprise value of all sector companies by the total sum of annual EBITDA of the companies. Airport Operators Services. Snapchat is at 177x after falling from 40x in Q4 2016 and still lost nearly 1bln in EBITDA on 18bln of revenue. The highs in 2017 were 14x but a more normalized multiple historically has been around 9x.

Source: cronkhitecapital.com

Source: cronkhitecapital.com

Advanced Medical Equipment Technology. What is the EBITDA Multiple. Auto Truck Manufacturers. This is higher than other companies within the Consumer Durables industry meaning investors expect Apple to grow faster than its peers. There are also some big deals in the pipeline such as the 2b private equity MYOB takeover over which.

Source: researchgate.net

Source: researchgate.net

EBITDA Multiple1226 959B 782B. Selling price divided by EBITDA earnings before interest taxes depreciation and amortization is a commonly used valuation multiple. The EBITDA multiple for a specific sector is calculated by dividing the total enterprise value of all sector companies by the total sum of annual EBITDA of the companies. Ad See what you can research. Interfinancial has reported January 2019 an average TMT EVEBITDA multiple of 137x and increasing where the ASX200 is running at 94x.

Source: corporatefinanceinstitute.com

Source: corporatefinanceinstitute.com

Published by Statista Research Department Jan 18 2021 Worldwide the average value of enterprise value to earnings before interest tax depreciation and amortization EVEBITDA in the. Come up with an industry average across peers for PE multiple EVEBITDA multiple revenue multiple and you can estimate how much your company is worth based on the industry benchmark. Typically SaaS companies command higher multiples PE or EBITDA due to the nature of their business being sticky ie. Auto Truck Manufacturers. The EBITDA stated is for the most recent 12-month period.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title tech company ebitda multiple by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 15+ Southeast asia tech unicorns info

- 16++ Big tech podcast ideas in 2021

- 11++ Tech area home info

- 13++ Opentable tech uk blog info

- 15++ Tech huawei blog information

- 13++ What does a technology evangelist do ideas in 2021

- 18++ Big tech net zero ideas

- 16++ Tech corp questions ideas

- 11+ Tech entrepreneur csc ideas in 2021

- 17+ Technical guruji net worth ideas