15++ Tech company valuation multiples 2020 information

Home » tech Info » 15++ Tech company valuation multiples 2020 informationYour Tech company valuation multiples 2020 images are available in this site. Tech company valuation multiples 2020 are a topic that is being searched for and liked by netizens today. You can Find and Download the Tech company valuation multiples 2020 files here. Get all free vectors.

If you’re looking for tech company valuation multiples 2020 images information connected with to the tech company valuation multiples 2020 topic, you have come to the right site. Our website always gives you suggestions for viewing the maximum quality video and image content, please kindly surf and locate more informative video content and graphics that match your interests.

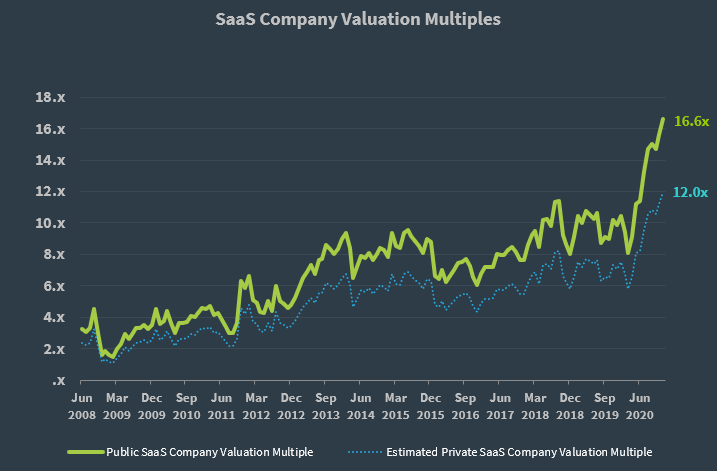

Tech Company Valuation Multiples 2020. Only positive EBITDA firms. The table below summarises eVals current month-end. US Revenue and EBITDA in 2021 are higher For American tech companies revenue and EBITDA multiples both are higher in 2021 with average revenue multiple of 61x in 2021 compared to 51x in 2020 and average EBITDA multiple of 293x compared to 247x. The chart below shows the long-term trend.

Valuation Multiples For Tech Companies Updated 2021 Download Data Set Microcap Co From microcap.co

Valuation Multiples For Tech Companies Updated 2021 Download Data Set Microcap Co From microcap.co

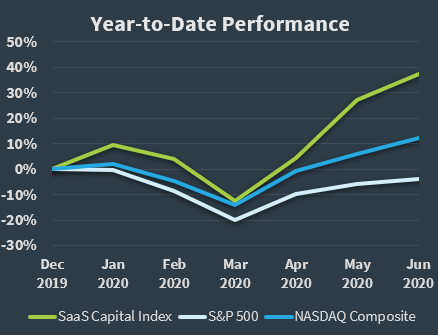

221 rows With Equidam you can seamlessly compute your valuation using 5 methods. Using the information above the next step is calculating Apples EBITDA valuation multiple. This led to a collapse in 2020 and 2021 earnings projections. Valuations in the public markets are at all-time highs. 5 Accredited Valuation Methods and PDF Report. The chart below shows the long-term trend.

This could be just a coincidence but one explanation could be that post-Covid lockdowns with people shifting their behavior to spend more time at home going forward US tech companies.

Over 12 times EBITDA per share to be exact. 198 rows Valuation Multiples by Industry. Over 12 times EBITDA per share to be exact. The chart below shows the long-term trend. 221 rows With Equidam you can seamlessly compute your valuation using 5 methods. 1226 959B 782B.

Source: microcap.co

Source: microcap.co

Industries and therefore multiples vary widely. 221 rows With Equidam you can seamlessly compute your valuation using 5 methods. The software internet industry saw the highest valuation multiples with 442x over double the 196x recorded in 2020. Below are revenue multiples for publicly traded consumer tech companies we follow B2C. The table below summarises eVals current month-end.

Source: microcap.co

Source: microcap.co

Ad See the value of a company before and after a round of funding. 5 Accredited Valuation Methods and PDF Report. We take a snapshot at the technology industry valuation multiples of IT firms and technology companies in Australia from the last 12 months how the sector will drive profits in a low growth economy and the key merger and acquisition issues to watch to get the best business valuation. 221 rows With Equidam you can seamlessly compute your valuation using 5 methods. See multiples and ratios.

Source: pinterest.com

Source: pinterest.com

1226 959B 782B. 198 rows Valuation Multiples by Industry. 1226 959B 782B. The data is as of June 30th. Companies may have the capital to make big acquisitions but extracting the value paid for deals will require different thinking in the current environment particularly with bigger deals that tend to have higher valuations.

Source: pinterest.com

Source: pinterest.com

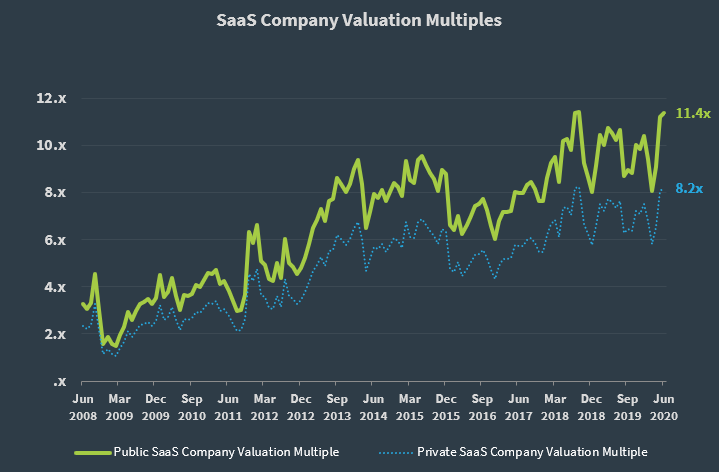

At the beginning of the year the SP 500 companies were forecast to earn 17777 and 19657 in 2020 and 2021 respectively. Only positive EBITDA firms. As of June 30 the median SaaS valuation multiple for public companies stands at 114x ARR. Tech valuations versus tech-enabled valuations. At the beginning of the year the SP 500 companies were forecast to earn 17777 and 19657 in 2020 and 2021 respectively.

Source: saas-capital.com

Source: saas-capital.com

Industries and therefore multiples vary widely. 1226 959B 782B. Ad See the value of a company before and after a round of funding. We take a snapshot at the technology industry valuation multiples of IT firms and technology companies in Australia from the last 12 months how the sector will drive profits in a low growth economy and the key merger and acquisition issues to watch to get the best business valuation. Using the information above the next step is calculating Apples EBITDA valuation multiple.

Source: saas-capital.com

Source: saas-capital.com

5 Accredited Valuation Methods and PDF Report. Industries and therefore multiples vary widely. 5 Accredited Valuation Methods and PDF Report. See multiples and ratios. Ad See the value of a company before and after a round of funding.

Source: cz.pinterest.com

Source: cz.pinterest.com

Below are revenue multiples for publicly traded consumer tech companies we follow B2C. Jul 7 2020 3 min read. Tech company multiples in Q2. Applying the historical private company discount of 28 the median valuation multiple for private SaaS companies is currently 82x ARR. Request your PitchBook free trial to see how our global data will benefit you.

Source: microcap.co

Source: microcap.co

5 Accredited Valuation Methods and PDF Report. Below are revenue multiples for publicly traded consumer tech companies we follow B2C. The data is as of June 30th. Request your PitchBook free trial to see how our global data will benefit you. Companies may have the capital to make big acquisitions but extracting the value paid for deals will require different thinking in the current environment particularly with bigger deals that tend to have higher valuations.

Source: saas-capital.com

Source: saas-capital.com

Ad No Financial Knowledge Required. 5 Accredited Valuation Methods and PDF Report. Below are revenue multiples for publicly traded consumer tech companies we follow B2C. Over 12 times EBITDA per share to be exact. See multiples and ratios.

Source: microcap.co

Source: microcap.co

Jul 7 2020 3 min read. Ad See the value of a company before and after a round of funding. The value of tech-enabled companies is coming into focus as several American. Ad No Financial Knowledge Required. US Revenue and EBITDA in 2021 are higher For American tech companies revenue and EBITDA multiples both are higher in 2021 with average revenue multiple of 61x in 2021 compared to 51x in 2020 and average EBITDA multiple of 293x compared to 247x.

Source: microcap.co

Source: microcap.co

Ad See the value of a company before and after a round of funding. 221 rows With Equidam you can seamlessly compute your valuation using 5 methods. 5 Accredited Valuation Methods and PDF Report. This led to a collapse in 2020 and 2021 earnings projections. Ad See the value of a company before and after a round of funding.

Source: microcap.co

Source: microcap.co

Tech valuations versus tech-enabled valuations. Apples EBITDA multiple of 1226 means investors are willing to pay a premium to buy shares of the company. Industries and therefore multiples vary widely. This could be just a coincidence but one explanation could be that post-Covid lockdowns with people shifting their behavior to spend more time at home going forward US tech companies. Tech valuations versus tech-enabled valuations.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title tech company valuation multiples 2020 by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 15+ Southeast asia tech unicorns info

- 16++ Big tech podcast ideas in 2021

- 11++ Tech area home info

- 13++ Opentable tech uk blog info

- 15++ Tech huawei blog information

- 13++ What does a technology evangelist do ideas in 2021

- 18++ Big tech net zero ideas

- 16++ Tech corp questions ideas

- 11+ Tech entrepreneur csc ideas in 2021

- 17+ Technical guruji net worth ideas