12++ Tech corp file a consolidated return ideas

Home » tech Info » 12++ Tech corp file a consolidated return ideasYour Tech corp file a consolidated return images are ready. Tech corp file a consolidated return are a topic that is being searched for and liked by netizens today. You can Download the Tech corp file a consolidated return files here. Get all royalty-free images.

If you’re looking for tech corp file a consolidated return images information related to the tech corp file a consolidated return keyword, you have visit the right blog. Our site always provides you with suggestions for refferencing the highest quality video and image content, please kindly search and find more enlightening video articles and images that match your interests.

Tech Corp File A Consolidated Return. A An election to file a consolidated return shall be made by the common parent corporation on behalf of all members of the affiliated group by filing Election to File Consolidated Kentucky Corporation Income and Limited Liability Entity Tax Return Form 722. The receipt of the dividend by Tech is not included again. Certain business entities are allowed to pass their profits and thus their tax burden to their owners. A consolidated return filing is multiple company returns that get pulled into one single consolidated tax return.

Ab6y8rmp9it1bm From

Ab6y8rmp9it1bm From

A An election to file a consolidated return shall be made by the common parent corporation on behalf of all members of the affiliated group by filing Election to File Consolidated Kentucky Corporation Income and Limited Liability Entity Tax Return Form 722. Eligible corporations that are affiliated generally based on at least 75 percent or more ownership of the statutory capital of the other affiliates and ownership of more than 50 percent of the voting rights may elect to file corporate income tax returns on a consolidated basis. Filing the Paperwork Each subsidiary company has to file a copy of IRS Form 1122 signed by a corporate officer with the first consolidated return. Election to file a consolidated return - Section 1501 of the Internal Revenue Code provides that all members of an affiliated group of corporations may elect to file a consolidated income tax return3 A consolidated return permits the includible corporations as defined in section. The consolidated tax return filing is much more complicated. A consolidated return filing is multiple company returns that get pulled into one single consolidated tax return.

The consolidated tax return filing is much more complicated.

A consolidated return filing is multiple company returns that get pulled into one single consolidated tax return. If a group elects to file consolidated returns it computes a single tax based on the incomes of all corporations in the group after numerous adjustments and eliminations. Choice C is incorrect. A An election to file a consolidated return shall be made by the common parent corporation on behalf of all members of the affiliated group by filing Election to File Consolidated Kentucky Corporation Income and Limited Liability Entity Tax Return Form 722. A group which did not file a consolidated return for the immediately preceding taxable year may file a consolidated return in lieu of separate returns for the taxable year provided that each corporation which has been a member during any part of the taxable year for which the consolidated return is to be filed consents in the manner provided in paragraph b of this section to the regulations under section 1502. Consolidated tax returns are a means of allowing corporations that are all part of an affiliated group to file one return for the annual period rather than each entity filing separately.

Source: kejari-kotaprobolinggo.kejaksaan.go.id

Source: kejari-kotaprobolinggo.kejaksaan.go.id

Choice C is incorrect. Election to file a consolidated return - Section 1501 of the Internal Revenue Code provides that all members of an affiliated group of corporations may elect to file a consolidated income tax return3 A consolidated return permits the includible corporations as defined in section. Choice C is incorrect. The Form 722 shall be attached to the return beginning with. What amount of this dividend is taxable on the 2016 consolidated return.

Source: pinterest.com

Source: pinterest.com

100 of the dividend is eliminated when a consolidated return is filed. During 2016 Dow paid a cash dividend of 20000 to Tech. Eligible corporations that are affiliated generally based on at least 75 percent or more ownership of the statutory capital of the other affiliates and ownership of more than 50 percent of the voting rights may elect to file corporate income tax returns on a consolidated basis. File Form 966 with the Internal Revenue Service Center at the address where the corporation or cooperative files its income tax return Distribution of Property. Electing to File a Consolidated Tax Return Each affiliated corporation must consent to file a consolidated tax return by filing Form 1122 and returning it along with Form 1120 the tax form for.

Source: nidec.com

Source: nidec.com

File Form 966 with the Internal Revenue Service Center at the address where the corporation or cooperative files its income tax return Distribution of Property. Eligible corporations that are affiliated generally based on at least 75 percent or more ownership of the statutory capital of the other affiliates and ownership of more than 50 percent of the voting rights may elect to file corporate income tax returns on a consolidated basis. If a consolidated group were comprised of a parent and one QSSS member you would create a total of either three or four returns in UltraTax CS depending on whether or not you want to have an eliminations member. The consolidated tax return filing is much more complicated. Parent entities not permitted to file returns electronically must file Form 8975 with their paper income tax return.

Source: kejari-kotaprobolinggo.kejaksaan.go.id

Source: kejari-kotaprobolinggo.kejaksaan.go.id

A An election to file a consolidated return shall be made by the common parent corporation on behalf of all members of the affiliated group by filing Election to File Consolidated Kentucky Corporation Income and Limited Liability Entity Tax Return Form 722. Once you have completed data entry for all the members and generated the 1120S Consolidated return create the electronic file as you would for any single-member client. Filing the Paperwork Each subsidiary company has to file a copy of IRS Form 1122 signed by a corporate officer with the first consolidated return. Election to File a Consolidated Return. The form gives the IRS the companys name taxpayer identification number and address.

Source: investopedia.com

Source: investopedia.com

By 1918 Congress had made the filing of consolidated returns mandatory for affiliated groups for purposes of not only the excess profits tax but also the income tax. If a group elects to file consolidated returns it computes a single tax based on the incomes of all corporations in the group after numerous adjustments and eliminations. Thus filing consolidated returns may substantially affect the groups overall tax liability since losses of one member may be used to offset income or gains of another member. Election to File a Consolidated Return. Filing the Paperwork Each subsidiary company has to file a copy of IRS Form 1122 signed by a corporate officer with the first consolidated return.

Source: pinterest.com

Source: pinterest.com

The consolidated tax return filing is much more complicated. This return is called a consolidated return and may be beneficial for offsetting losses from. 100 of the dividend is eliminated when a consolidated return is filed. The rules involving the distribution of property are complicated. By 1918 Congress had made the filing of consolidated returns mandatory for affiliated groups for purposes of not only the excess profits tax but also the income tax.

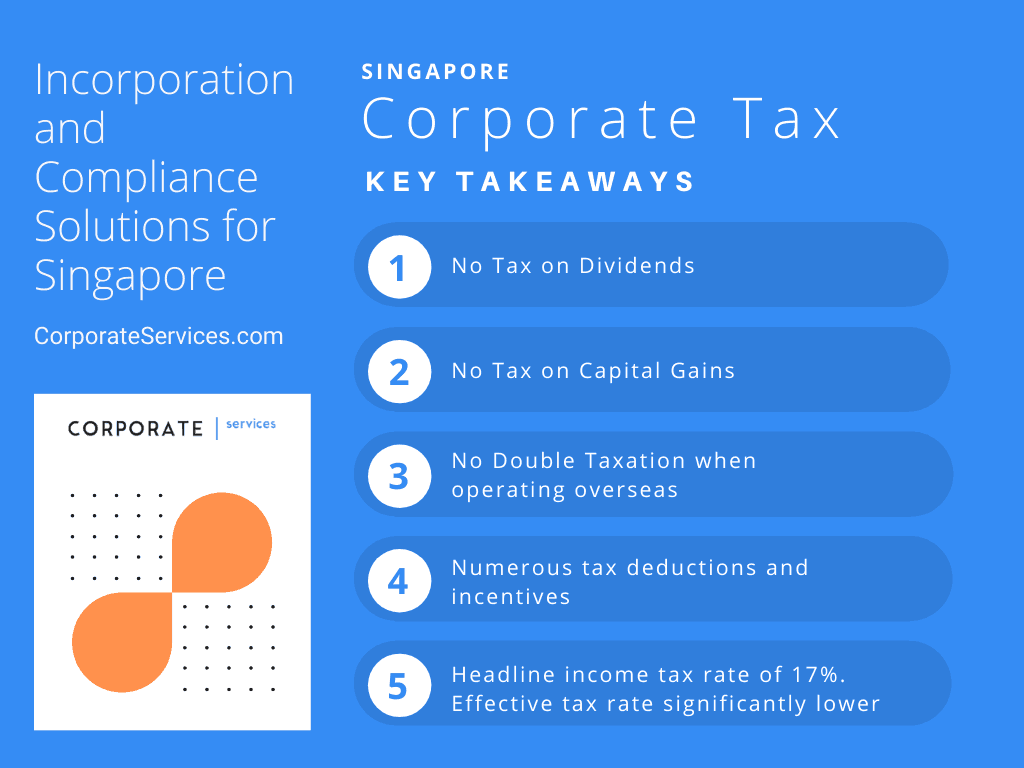

Source: corporateservices.com

Source: corporateservices.com

Consolidated tax returns are a means of allowing corporations that are all part of an affiliated group to file one return for the annual period rather than each entity filing separately. Electing to File a Consolidated Tax Return Each affiliated corporation must consent to file a consolidated tax return by filing Form 1122 and returning it along with Form 1120 the tax form for. Files a consolidated return with its wholly owned subsidiary Dow Corp. Commissioner used this power to require the filing of consolidated tax returns by affiliated corporations to limit the benefits of multiple corporations. The Form 722 shall be attached to the return beginning with.

Source:

Source:

Form 8975 and its schedules can be filed in the Modernized e-File MeF XML schema format. Consolidated tax returns are a means of allowing corporations that are all part of an affiliated group to file one return for the annual period rather than each entity filing separately. During 2016 Dow paid a cash dividend of 20000 to Tech. The form gives the IRS the companys name taxpayer identification number and address. Electing to File a Consolidated Tax Return Each affiliated corporation must consent to file a consolidated tax return by filing Form 1122 and returning it along with Form 1120 the tax form for.

Source:

Source:

What amount of this dividend is taxable on the 2016 consolidated return. The rules involving the distribution of property are complicated. The ability to file together depends on the exact nature of the connection between the parent organization and any subsidiaries that make up the group. This return is called a consolidated return and may be beneficial for offsetting losses from. If you need to attach a Portable Document Format PDF document to the electronic file you should attach the PDF with the consolidated return not with the member returns.

Source: viewpoint.pwc.com

Source: viewpoint.pwc.com

What amount of this dividend is taxable on the 2016 consolidated return. Electing to File a Consolidated Tax Return Each affiliated corporation must consent to file a consolidated tax return by filing Form 1122 and returning it along with Form 1120 the tax form for. As the two corporations file a consolidated return 100 of the dividends are eliminated not taxable. This answer is 70 of the 20000 dividend. If a consolidated group were comprised of a parent and one QSSS member you would create a total of either three or four returns in UltraTax CS depending on whether or not you want to have an eliminations member.

Source: pinterest.com

Source: pinterest.com

The receipt of the dividend by Tech is not included again. The Form 722 shall be attached to the return beginning with. Consolidated tax returns are a means of allowing corporations that are all part of an affiliated group to file one return for the annual period rather than each entity filing separately. Election to file a consolidated return - Section 1501 of the Internal Revenue Code provides that all members of an affiliated group of corporations may elect to file a consolidated income tax return3 A consolidated return permits the includible corporations as defined in section. Parent entities not permitted to file returns electronically must file Form 8975 with their paper income tax return.

Source: lowtax.net

Source: lowtax.net

If a consolidated group were comprised of a parent and one QSSS member you would create a total of either three or four returns in UltraTax CS depending on whether or not you want to have an eliminations member. Election to file a consolidated return - Section 1501 of the Internal Revenue Code provides that all members of an affiliated group of corporations may elect to file a consolidated income tax return3 A consolidated return permits the includible corporations as defined in section. Filing the Paperwork Each subsidiary company has to file a copy of IRS Form 1122 signed by a corporate officer with the first consolidated return. If you do not want to have an eliminations member set up a parent a subsidiary and a consolidated return. A group which did not file a consolidated return for the immediately preceding taxable year may file a consolidated return in lieu of separate returns for the taxable year provided that each corporation which has been a member during any part of the taxable year for which the consolidated return is to be filed consents in the manner provided in paragraph b of this section to the regulations under section 1502.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title tech corp file a consolidated return by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 15+ Southeast asia tech unicorns info

- 16++ Big tech podcast ideas in 2021

- 11++ Tech area home info

- 13++ Opentable tech uk blog info

- 15++ Tech huawei blog information

- 13++ What does a technology evangelist do ideas in 2021

- 18++ Big tech net zero ideas

- 16++ Tech corp questions ideas

- 11+ Tech entrepreneur csc ideas in 2021

- 17+ Technical guruji net worth ideas