20+ Tech debt equity ratio ideas in 2021

Home » tech Info » 20+ Tech debt equity ratio ideas in 2021Your Tech debt equity ratio images are ready. Tech debt equity ratio are a topic that is being searched for and liked by netizens today. You can Get the Tech debt equity ratio files here. Get all free vectors.

If you’re looking for tech debt equity ratio images information related to the tech debt equity ratio topic, you have come to the right site. Our site always gives you suggestions for refferencing the maximum quality video and picture content, please kindly surf and find more informative video articles and graphics that fit your interests.

Tech Debt Equity Ratio. This metric is useful when analyzing. Leverage Ratios A leverage ratio indicates the level of debt incurred by a business entity against several other accounts in its balance sheet income statement or. 75 rows Debt-to-equity ratio is a financial ratio indicating the relative proportion of entitys. Seagate Technology Holdings debtequity for the three months ending March 31 2021 was 1012.

Debt To Equity Ratio Calculator Discoverci From discoverci.com

Debt To Equity Ratio Calculator Discoverci From discoverci.com

The Debt to Equity ratio also called the debt-equity ratio risk ratio or gearing is a leverage ratio. Compare STX With Other Stocks. Debt to Equity Ratio Definition. A high debt equity ratio is a bad sign for the safety of investment. The debtequity ratio can be defined as a measure of a companys financial leverage calculated by dividing its long-term debt by stockholders equity. L3Harris Technologies Inc debtequity for the three months ending March 31 2021 was 034.

The Debt to Equity ratio also called the debt-equity ratio risk ratio or gearing is a leverage ratio.

In simple words it is the ratio of the total liabilities of a company and its. If the debt is decreasing over a period of time it is a good sign. Data for this Date Range. In depth view into TPT Global Tech Debt to Equity Ratio including historical data from 2020 charts stats and industry comps. The debtequity ratio can be defined as a measure of a companys financial leverage calculated by dividing its long-term debt by stockholders equity. The Debt to Equity ratio also called the debt-equity ratio risk ratio or gearing is a leverage ratio.

Source: educba.com

Source: educba.com

In depth view into TPT Global Tech Debt to Equity Ratio including historical data from 2020 charts stats and industry comps. Tetra Tech debtequity for the three months ending March 31 2021 was 021. The debt to equity ratio measures the Long Term Debt Current Portion of Long Term Debt Total Shareholders Equity. As of 2020 the debt ratio of the global tech industry stood at 26 percent the. The Debt to Equity DE ratio is a straightforward metric that calculates the proportion of the debt of a company relative to its equity.

Source: investopedia.com

Source: investopedia.com

The Debt to Equity DE ratio is a straightforward metric that calculates the proportion of the debt of a company relative to its equity. The debtequity ratio can be defined as a measure of a companys financial leverage calculated by dividing its long-term debt by stockholders equity. The Debt to Equity ratio also called the debt-equity ratio risk ratio or gearing is a leverage ratio. 49 rows The debtequity ratio can be defined as a measure of a companys financial leverage. In simple words it is the ratio of the total liabilities of a company and its.

Source: discoverci.com

Source: discoverci.com

A high debt equity ratio is a bad sign for the safety of investment. Tetra Tech debtequity for the three months ending March 31 2021 was 021. Start your Free Trial. This statistic displays the ratio of total debt and total assets of the global technology industry from 2007 to 2020. The debt-to-equity ratio is a financial leverage ratio which is frequently calculated and analyzed that compares a companys total liabilities to its shareholder equity.

Source: wikihow.com

Source: wikihow.com

Take note that some businesses are more capital intensive than others. A DE ratio of 1 means its debt is equivalent to its common equity. 49 rows The debtequity ratio can be defined as a measure of a companys financial leverage. View and export this data going back to 2012. Tetra Tech debtequity for the three months ending March 31 2021 was 021.

Source: pinterest.com

Source: pinterest.com

The debt to equity ratio measures the Long Term Debt Current Portion of Long Term Debt Total Shareholders Equity. The debtequity ratio can be defined as a measure of a companys financial leverage calculated by dividing its long-term debt by stockholders equity. If the debt is decreasing over a period of time it is a good sign. 75 rows Debt-to-equity ratio is a financial ratio indicating the relative proportion of entitys. L3Harris Technologies Inc debtequity for the three months ending March 31 2021 was 034.

Source: marketbusinessnews.com

Source: marketbusinessnews.com

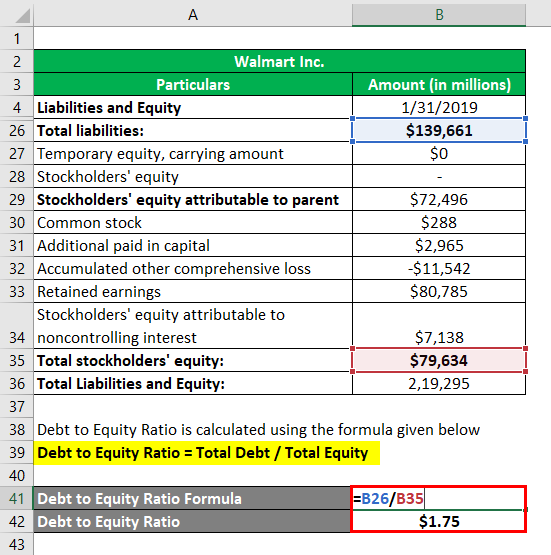

December 16 2020 by Harbourfront Technologies 0 comments on Debt to Equity Ratio Formula Debt to Equity Ratio Formula. View and export this data going back to 2012. The debtequity ratio can be defined as a measure of a companys financial leverage calculated by dividing its long-term debt by stockholders equity. Data for this Date Range. Leverage Ratios A leverage ratio indicates the level of debt incurred by a business entity against several other accounts in its balance sheet income statement or.

Source: investopedia.com

Source: investopedia.com

The debtequity ratio can be defined as a measure of a companys financial leverage calculated by dividing its long-term debt by stockholders equity. A company which has high debt in comparison to its net worth has to spend a large part of its profit in paying off the interest and the principal amount. A high debt equity ratio is a bad sign for the safety of investment. The debtequity ratio can be defined as a measure of a companys financial leverage calculated by dividing its long-term debt by stockholders equity. Take note that some businesses are more capital intensive than others.

Source: wikihow.com

Source: wikihow.com

The Debt to Equity DE ratio is a straightforward metric that calculates the proportion of the debt of a company relative to its equity. The debtequity ratio can be defined as a measure of a companys financial leverage calculated by dividing its long-term debt by stockholders equity. The debtequity ratio can be defined as a measure of a companys financial leverage calculated by dividing its long-term debt by stockholders equity. On the trailing twelve months basis Technology Sectors Cash cash equivalent grew by 941 in the 1 Q 2021 sequentially faster than Current Liabilities this led to improvement in Technology Sectors Quick Ratio to 106 in the 1 Q 2021 Quick Ratio remained below Technology Sector average. Tetra Tech debtequity for the three months ending March 31 2021 was 021.

Source: educba.com

Source: educba.com

The Debt to Equity DE ratio is a straightforward metric that calculates the proportion of the debt of a company relative to its equity. A DE ratio of 1 means its debt is equivalent to its common equity. 75 rows Debt-to-equity ratio is a financial ratio indicating the relative proportion of entitys. This metric is useful when analyzing. Data for this Date Range.

Source: investopedia.com

View and export this data going back to 2012. The debtequity ratio can be defined as a measure of a companys financial leverage calculated by dividing its long-term debt by stockholders equity. If the debt is decreasing over a period of time it is a good sign. L3Harris Technologies Inc debtequity for the three months ending March 31 2021 was 034. 75 rows Debt-to-equity ratio is a financial ratio indicating the relative proportion of entitys.

Source: educba.com

Source: educba.com

View and export this data going back to 2012. December 16 2020 by Harbourfront Technologies 0 comments on Debt to Equity Ratio Formula Debt to Equity Ratio Formula. Seagate Technology Holdings debtequity for the three months ending March 31 2021 was 1012. The debt-to-equity ratio is a financial leverage ratio which is frequently calculated and analyzed that compares a companys total liabilities to its shareholder equity. The Debt to Equity DE ratio is a straightforward metric that calculates the proportion of the debt of a company relative to its equity.

Source: wikihow.com

Source: wikihow.com

Take note that some businesses are more capital intensive than others. On the trailing twelve months basis Technology Sectors Cash cash equivalent grew by 941 in the 1 Q 2021 sequentially faster than Current Liabilities this led to improvement in Technology Sectors Quick Ratio to 106 in the 1 Q 2021 Quick Ratio remained below Technology Sector average. Take note that some businesses are more capital intensive than others. The debtequity ratio can be defined as a measure of a companys financial leverage calculated by dividing its long-term debt by stockholders equity. Start your Free Trial.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title tech debt equity ratio by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 15+ Southeast asia tech unicorns info

- 16++ Big tech podcast ideas in 2021

- 11++ Tech area home info

- 13++ Opentable tech uk blog info

- 15++ Tech huawei blog information

- 13++ What does a technology evangelist do ideas in 2021

- 18++ Big tech net zero ideas

- 16++ Tech corp questions ideas

- 11+ Tech entrepreneur csc ideas in 2021

- 17+ Technical guruji net worth ideas